You own five “different” tech ETFs. But did you know 40% of your portfolio is actually the same seven companies?

That’s the kind of hidden risk that AI portfolio optimization tools catch in seconds. Correlations humans miss. Concentration you didn’t realize you had. Tax-saving opportunities sitting there unclaimed.

I’ve used ChatGPT to help me build budgets and project my finances, but I’d never let AI actually touch my investments. So I wanted to learn: what can these tools actually do? Are they glorified calculators, or something genuinely useful?

⚠️ This post is for educational purposes only and is not financial advice. Investment decisions involve risk, and past performance doesn’t guarantee future results. Consider consulting a qualified financial advisor before making investment changes.

AI portfolio optimization uses machine learning to analyze your investments and suggest improvements based on your specific goals, timeline, and risk tolerance. It goes beyond simple “60/40” rules to find personalized recommendations.

The quick answer: Start with free analysis before handing over money. Empower (formerly Personal Capital) offers free portfolio analysis showing your allocation, hidden fees, and basic recommendations. For actual robo-management, Wealthfront and Betterment charge about 0.25% annually and add real value through tax-loss harvesting and automatic rebalancing.

This is Part 17 of our 20-part series on how AI can improve your life in 2026. See all parts →

What Is AI Portfolio Optimization?

AI portfolio optimization uses machine learning to analyze your investments and suggest improvements. Instead of following rigid rules like “60% stocks, 40% bonds,” these tools look at your specific situation, goals, risk tolerance, and market conditions to make personalized recommendations.

Think of it like having a financial advisor who never sleeps, constantly monitors market conditions, and can process way more data than any human could.

How AI Portfolio Optimization Tools Actually Work

Most AI investment tools follow a similar pattern:

1. Portfolio Analysis

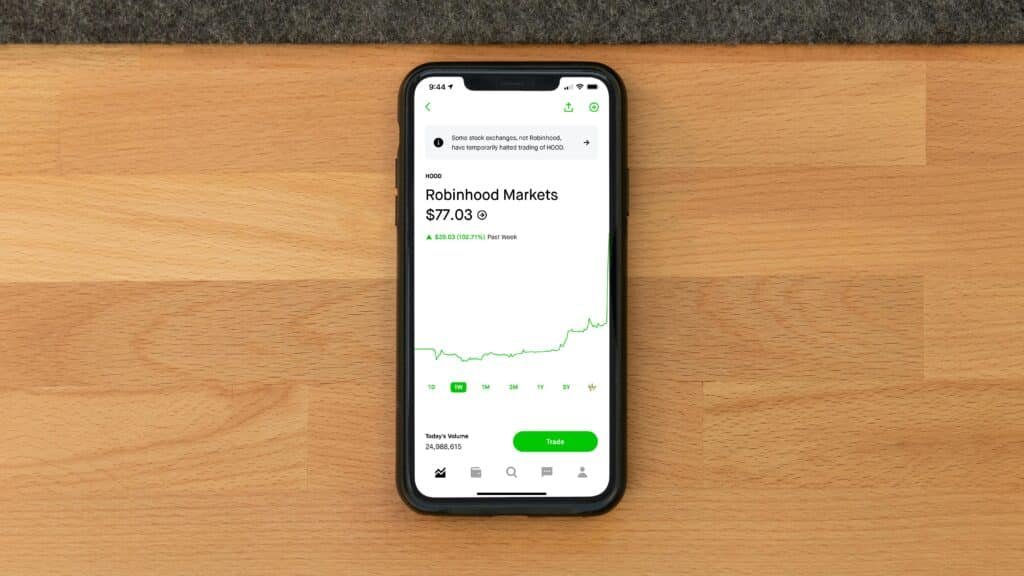

You connect your brokerage accounts or manually enter your holdings. The AI then analyzes your current allocation across asset classes, sectors, geographic regions, and risk factors. It identifies concentration risks you might not have noticed (like owning five “different” tech ETFs that all hold the same companies).

2. Goal Alignment

The tool asks about your timeline, risk tolerance, and goals. Are you saving for retirement in 30 years or a house down payment in 3? This dramatically changes what an “optimal” portfolio looks like.

3. Recommendation Engine

Based on modern portfolio theory and machine learning models, the AI suggests specific changes. Maybe you’re overweight in one sector, or your bond allocation doesn’t match your age and risk profile.

4. Ongoing Monitoring

The best AI portfolio optimization tools don’t just give you one-time advice. They continuously monitor your portfolio and alert you when rebalancing is needed or when market conditions change significantly.

Best AI Portfolio Optimization Tools in 2026

Here’s what’s actually useful for AI portfolio optimization:

Wealthfront

Wealthfront is probably the most established robo-advisor with genuine AI capabilities. Their “Path” feature uses AI to project your financial future and show how different decisions affect your outcomes. The tax-loss harvesting is automatic and has saved users real money.

Betterment

Betterment takes a similar approach but with more emphasis on goal-based investing. You set up “buckets” for different goals (retirement, emergency fund, vacation), and the AI optimizes each differently based on timeline.

Magnifi by TIFIN

Magnifi is fascinating because it’s essentially ChatGPT for investing. You can ask natural language questions like “Find me low-cost ETFs focused on clean energy” or “How does my portfolio compare to a typical 35-year-old’s?” The AI responds with specific, actionable answers.

Composer

Composer is for people who want more control. You can build automated trading strategies using a no-code interface, and the AI helps optimize and backtest them. It’s more advanced but incredibly powerful if you want to implement specific investment rules.

ChatGPT and Claude for Analysis

Don’t overlook general AI assistants. I regularly use ChatGPT and Claude to explain investment concepts, analyze earnings reports, or think through allocation decisions. They won’t manage your money, but they’re great for education and research.

What AI Portfolio Optimization Can Actually Do

Let me be specific about the real benefits:

Find Hidden Risks

You might think you’re diversified until an AI tool shows you that 40% of your “diversified” portfolio is effectively exposed to the same handful of mega-cap tech companies through various ETFs. That’s a correlation risk you’d never spot manually.

Tax Optimization

Tax-loss harvesting used to be something only wealthy people with accountants could do effectively. AI tools automate this, selling losing positions to offset gains while maintaining your market exposure. Wealthfront claims their tax-loss harvesting adds about 1.8% to annual returns.

Emotional Buffer

When markets drop 20%, most people’s instinct is to panic sell. Having an AI tell you “Your portfolio is performing within expected parameters for your risk level. No action recommended” is genuinely calming. It’s like having a steady hand on your shoulder during turbulence.

Rebalancing Alerts

Portfolio drift is real. If stocks surge, suddenly your 70/30 stock/bond allocation becomes 80/20. AI portfolio optimization tools notify you when rebalancing is needed and often execute it automatically.

The Honest Limitations

AI portfolio optimization tools aren’t magic, and I want to be upfront about their shortcomings:

They can’t predict the market. No AI can consistently predict what stocks will go up or down. Anyone who tells you otherwise is selling something. These tools optimize based on historical patterns and modern portfolio theory, not crystal balls.

Fees add up. Robo-advisors typically charge 0.25-0.50% annually. On a $100,000 portfolio, that’s $250-500 per year. For simple buy-and-hold index investing, you might not need that cost.

They’re not personalized enough for complex situations. If you have stock options, rental properties, a pension, and complex tax situations, AI tools may not capture the full picture. A human financial advisor might still be worth it for truly complicated finances.

Past performance doesn’t guarantee future results. AI models are trained on historical data. Black swan events (like a global pandemic) can break assumptions built into any model.

How to Get Started with AI Portfolio Optimization

If you’re ready to try AI-powered investing, here’s a practical path:

Start with Analysis, Not Management

Before handing over your money, use free tools to analyze what you already have. Empower (formerly Personal Capital) offers free portfolio analysis that shows your allocation, fees you’re paying, and basic recommendations.

Ask Questions First

Use ChatGPT or Claude to understand concepts before making changes. Ask things like “Explain dollar-cost averaging like I’m 12” or “What’s the difference between total stock market and S&P 500 index funds?” Build your knowledge base.

Start Small with Robo-Advisors

Most platforms have low or no minimums now. Start with $500-1000 to get a feel for how AI portfolio optimization manages money before committing larger amounts.

Keep Some Manual Control

Many people keep about 80% in robo-managed accounts and 20% in a self-directed account where they can make their own decisions. It satisfies the urge to “do something” without letting emotions wreck the main portfolio.

Common Questions About AI Portfolio Optimization

Is AI investing better than a human financial advisor?

For straightforward situations (regular income, standard accounts, basic goals), AI tools often perform as well as human advisors at a fraction of the cost. For complex situations involving business ownership, estate planning, or unique tax circumstances, human advisors still add significant value.

Can AI investment tools actually beat the market?

Most don’t try to. Reputable AI portfolio optimization tools focus on matching your risk tolerance, minimizing taxes, and reducing fees rather than chasing above-market returns. That’s actually a more realistic and valuable goal.

How safe is my money with robo-advisors?

Major robo-advisors like Wealthfront and Betterment use established brokerages (like Schwab) to custody your assets. Your money is protected by SIPC insurance up to $500,000, just like at traditional brokerages.

Should I use AI portfolio tools if I’m just starting to invest?

Absolutely. In fact, beginners might benefit most. AI tools enforce good behavior (diversification, not panic selling, regular rebalancing) that experienced investors had to learn the hard way.

Related Reading

If you found this helpful, check out these related posts:

- How to Use ChatGPT for Personal Finance

- Part 18: AI Fraud Detection for Your Accounts

- Start Here to see all our AI guides for beginners

Series Navigation: ← Part 16: AI Explains Complex Topics | Series Hub | Part 18: AI Fraud Detection →

Leave a Reply